The FCA announced on 5th March 2021 future cessation of the 35 LIBOR benchmark settings currently published by ICE Benchmark Administration (IBA), which constitutes an index cessation event under the IBOR Fallbacks Supplement and the ISDA 2020 IBOR Fallbacks Protocol. This announcement triggers the official fallback spread calculation published by Bloomberg

The announced end-dates are the same as the ones in the IBA consultations launched in late November.

- Immediately after 31 December 2021, in the case of all sterling, euro, Swiss franc and Japanese yen settings, and the 1-week and 2-month US dollar settings;

- Immediately after 30 June 2023, in the case of the remaining US dollar settings

Short Sterling futures (and Swiss Franc futures) are likely to cease trading post December 2021 with the Eurodollar futures likely to cease trading post June 2023. Euribor futures will continue.

Any contracts settling after these end-dates will include the official fallback spread. The Eurodollar M3U3 spread therefore should lock to 26.26bps for 3M USD LIBOR and the Short Sterling Z1H3 spread should be 12.93bps

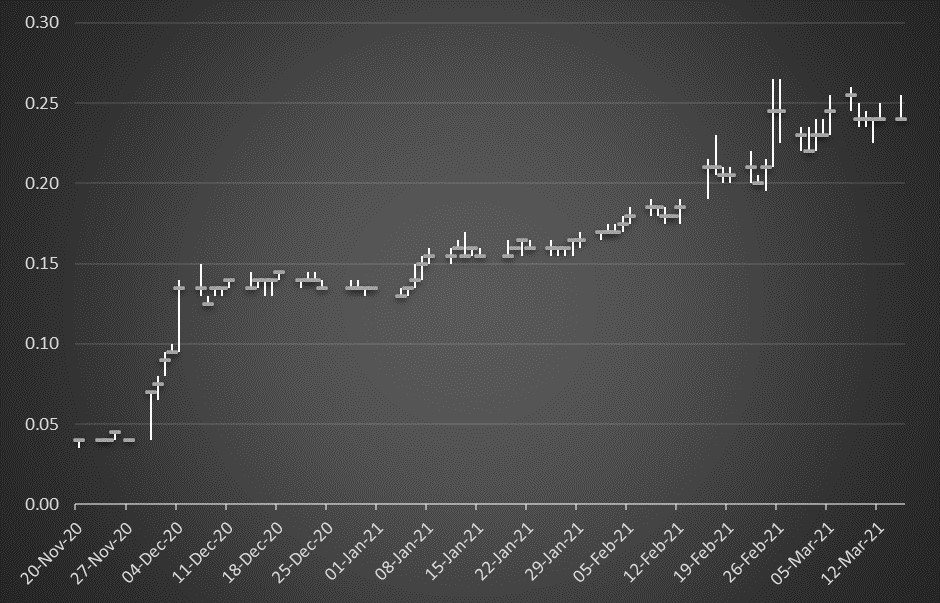

Eurodollar M3U3 spread

The Eurodollar M3U3 spread closed at 0.24 on 15th March, a discount of ≈2bps.

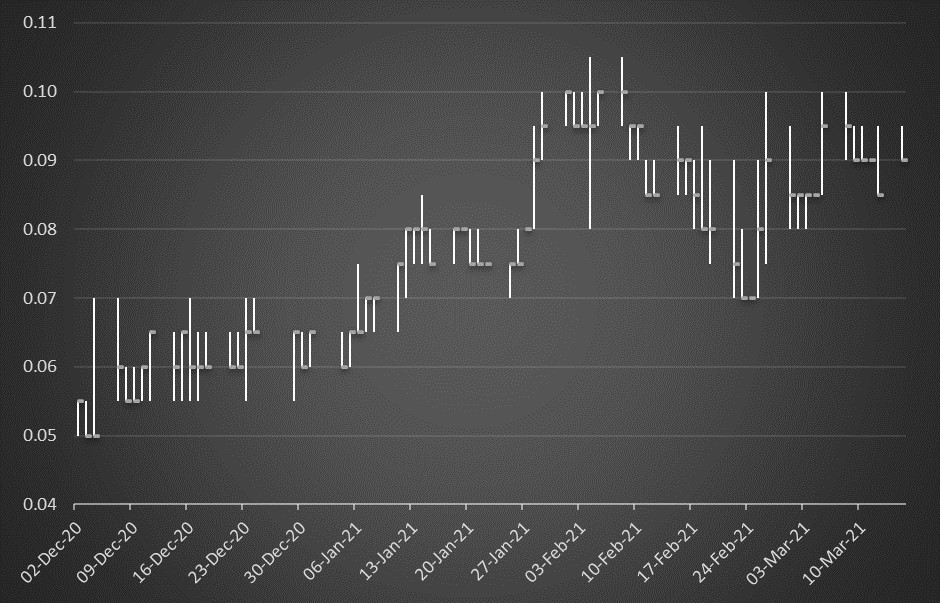

Short Sterling Z1H2 spread

The Short Sterling Z1H2 spreadclosed at 0.09 on 15th March, a discount of ≈4bps.

These discounts reflect potential uncertainty surrounding the FCA announcement that it plans to consult on requiring IBA to continue to publish a synthetic GBP Libor (for a “further period” after end-December 2021). It has also said it will “consider a case” for a synthetic USD Libor to be published for use in tough legacy contracts after end June 2023. This means that there could be a small possibility of these futures continuing beyond the cessation dates.

The eventual discontinuation of Short Sterling, Swiss Franc and Eurodollar futures will mean that there will be no exchange traded derivative product offering a credit element. No more TED spreads or invoice spreads. Eurodollar futures account for about 8% of CME Group revenues with no early indications that SOFR futures will be a viable replacement in terms of volume and open interest.