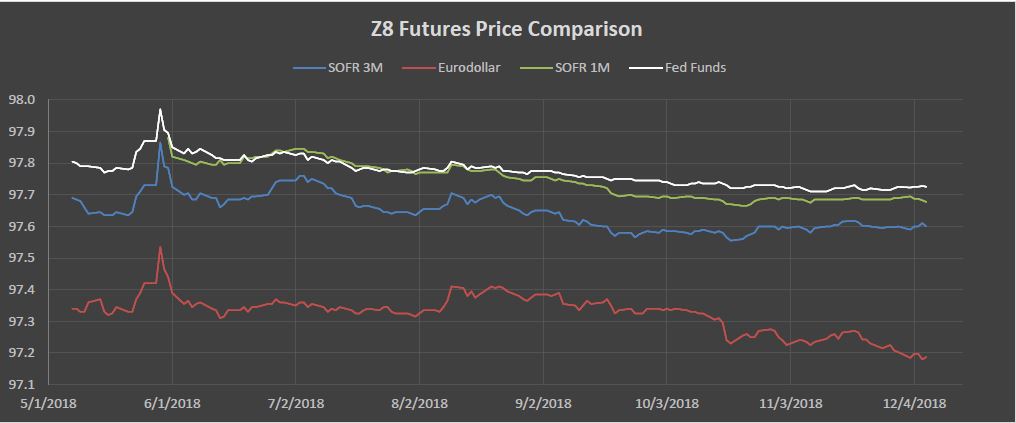

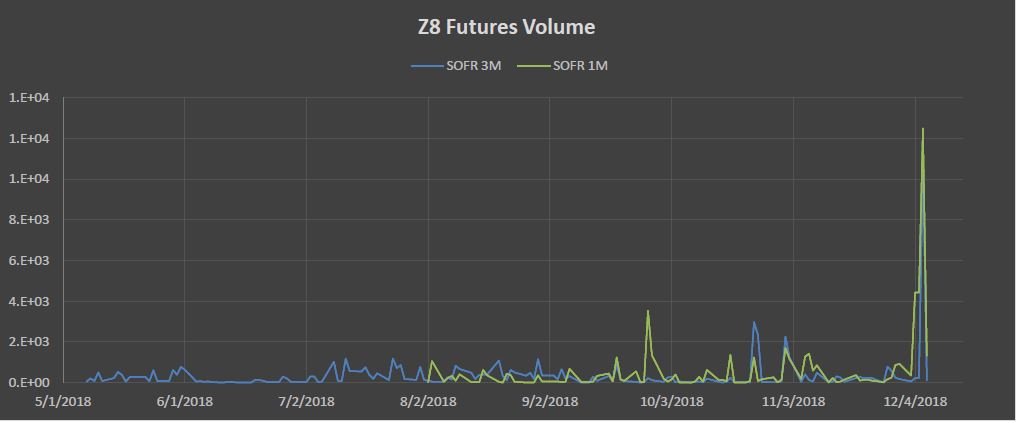

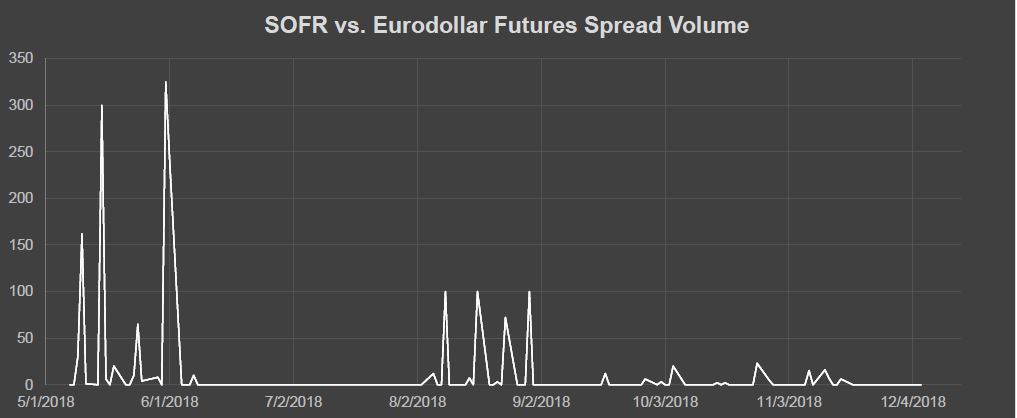

As global financial markets transition away from LIBOR, the Secured Overnight Financing Rate (SOFR) has emerged as the leading benchmark for USD-denominated short-term interest rates. SOFR futures, particularly those traded on the Chicago Mercantile Exchange (CME), are now essential tools for hedging, trading, and managing interest rate risk.

What Is SOFR?

SOFR is a daily overnight rate based on actual transactions in the U.S. Treasury repo market. It reflects the cost of borrowing cash overnight collateralized by Treasury securities. Unlike LIBOR, SOFR is:

– Transparent: Based on real transactions

– Robust: Covers a broad market

– Reliable: Free from manipulation

Global Equivalents:

– UK: SONIA

– EU: €STR

From LIBOR to SOFR: A Timeline

– 2014: The Federal Reserve forms the Alternative Reference Rates Committee (ARRC).

– 2017: ARRC endorses SOFR.

– 2018: SOFR begins daily publication.

– 2023: USD LIBOR ends; CME Eurodollar futures replaced by SOFR futures.

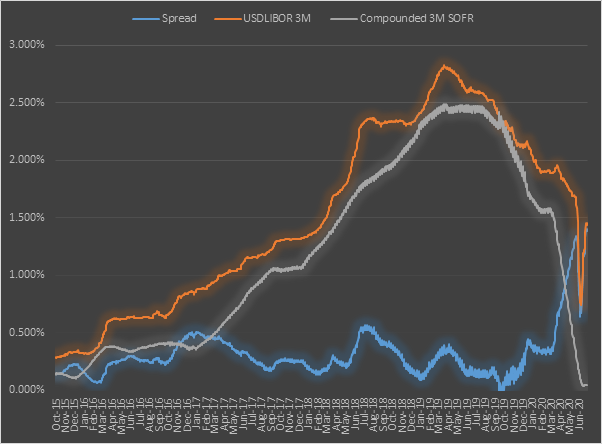

Forward vs. Backward-Looking Rates

LIBOR was forward-looking, meaning interest payments were known at the start of the period. SOFR is backward-looking, with payments calculated in arrears using compounded daily rates.

Example: Compounded SOFR Calculation

Suppose SOFR rates over a week are:

– Mon: 1.63%

– Tue–Fri: 1.55%

– Fri covers 3 days (weekend)

Using the compounding formula, the effective rate is calculated as:

R = [∏(1 + (di/360) × (ri/100)) – 1] × (360/D) × 100

Resulting in an effective rate of 1.5602%.

CME Three-Month SOFR Futures

These contracts allow market participants to lock in interest rates for a future period.

Specifications:

– Contract Size: $25 per basis point per annum

– Price Basis: IMM Index = 100 – R

– Reference Quarter: 3rd Wednesday of the 3rd month before delivery to 3rd Wednesday of delivery month

– Settlement: Cash-settled based on realized SOFR

Example: May 2025 future

May 2025 SOFR future comes to final settlement on the third Wednesday of August 2025.

The interval of interest rate exposure that informs the contract final settlement price – the contract Reference Quarter — starts on the third Wednesday of May 2025 and ends on the third Wednesday of August 2025. Referenced as May contract even though it settles in August

Sofr futures uses: Hedging a Corporate Loan

A U.S. company borrows $100 million at SOFR for 3 months. Concerned about rising rates, it sells 100 September SOFR futures at 94.50, locking in a rate of 5.5%.

– If SOFR rises to 6%, loan interest = $1.5 million

– Futures profit = 100 × 50 × $25 = $125,000

– Net borrowing cost = $1.375 million → Effective rate = 5.5%

Example 2: Speculating on Rate Declines

An investor expects SOFR to fall from 5.3% to 5.0%. They buy 50 SOFR futures at 94.70.

– If SOFR drops to 5.0%, futures settle at 95.00

– Gain = 50 × 30 × $25 = $37,500

Convexity Bias in SOFR Futures

SOFR futures are linear instruments with a constant DV01 ($25). Swaps, however, are convex, meaning their DV01 changes with rate and time.

Example: Swap vs. Futures Hedge

A 2-year swap with a DV01 of $185.94 is hedged using 7.45 SOFR futures. As rates change:

– Rates fall: Swap DV01 increases → gain > futures loss

– Rates rise: Swap DV01 decreases → loss < futures gain

This mismatch creates a convexity bias, which is priced into SOFR futures.

Conclusion

SOFR futures are indispensable tools in today’s interest rate landscape. Whether you’re a corporate treasurer hedging loan costs, a trader speculating on rate movements, or a risk manager balancing swap exposures, understanding SOFR futures is essential.

Their transparency, liquidity, and alignment with real market transactions make them a powerful instrument for managing short-term interest rate risk.