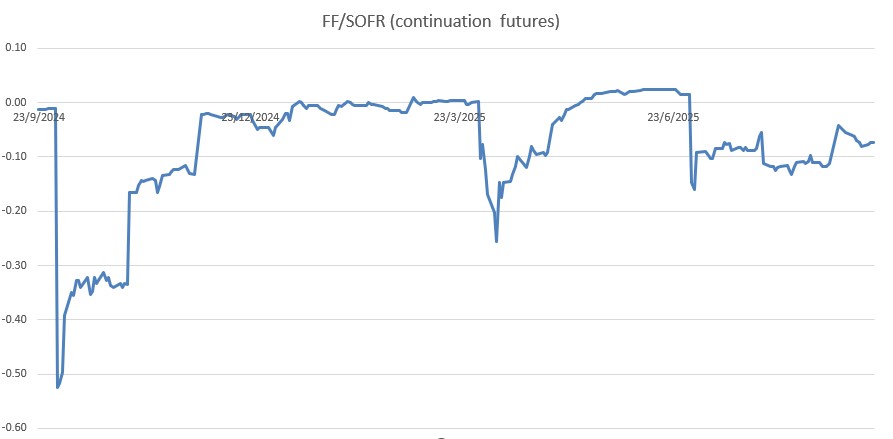

At quarter-end, US money markets often experience temporary funding pressures. This is due to factors like large Treasury settlements, tax payments, and regulatory reporting dates, which can cause volatility in short-term rates such as the Secured Overnight Financing Rate (SOFR) and the effective Fed funds rate (FF). The spread between these two rates (SOFR/FF) can widen or narrow sharply around these dates

Why Does the Spread Move?

- Quarter-end effects: Banks and money market funds adjust their balance sheets for regulatory reasons, often leading to a temporary drain in reserves from the system.

- Foreign banks (FBOs): These institutions hold large reserves at the Fed, much of which is funded in repo markets. At quarter-end, they willingly shed reserves as their demand temporarily drops, moving cash into the Fed’s Overnight Reverse Repo Facility (ONRRP). This is a temporary pullback, not a sign of systemic stress.

- Market pricing: As a result, the SOFR/FF spread can become more negative, reflecting perceived funding risk.

- Buy SOFR futures and sell Fed funds futures. As quarter-end passes and funding pressures ease, the spread should narrow (become less negative), allowing the trade to profit.

Trade example:

- Initiate the Trade:

- Buy 1 contract 1m SOFR futures.

- Sell 1 contract 1m Fed funds futures.

- @ -15bp.

- Quarter-End Passes:

- Funding pressures ease.

- The spread narrows to -10bp (SOFR rises relative to FF, or FF falls relative to SOFR).

- Close the Trade:

- Sell the SOFR futures contract.

- Buy back the Fed funds futures contract.

- The spread has change of +5.0bp.

- Profit Calculation:

- Each basis point move in the spread is worth a fixed amount per contract (depending on contract specs).

- If the notional value per bp is, for example, $41.67 per contract:

- Profit = 5bp × $41.67 = $208 per contract